Anand Sharma to address at National Seminar on "Industrial Productivity for Inclusive Growth"

Mumbai, Source: Business Standard

|

MTM risks to the Indian banking sector are limited and manageable.

The Indian banking system is resilient to the shocks that may arise due to higher non-performing assets (NPAs) and the global economic crisis, the Reserve Bank of India’s (RBI’s) stress test has shown.

The Union Minister of Commerce and Industry, Shri Anand Sharma addressing the National Seminar on “Industrial Productivity for Inclusive Growth”

|

RBI’s Annual Report-2008-09 said the test was done to assess the capital adequacy of the banks to sustain losses from deteriorating asset quality, primarily due to falling external demand in the wake of the global recession a subsequent slowing of domestic private demand.

A similar test was done to assess the risks associated with the mark-to-market (MTM) losses on the banks’ overseas exposure. MTM means stating losses based on the current market value of the currency. The assessment, done in 2008, suggested that the MTM risks to the Indian banking sector appeared limited and manageable.

The exercise tested the banks’ exposure to seven sectors whose prospects have dampened due to the slowdown in external demand.

The sectors were chemicals/dyes/paints, leather and leather products, gems and jewellery, construction , automobiles, iron and steel, and textiles. These account for 15.4 per cent of total advances and 12.2 per cent of gross NPAs of Indian banks. The test assumed 300 per cent and 400 per cent simultaneous rise in NPAs in these sectors and adjusted the additional provisioning requirements from existing capital and risk-weighted assets. Barring two banks, which accounted for 3 per cent of the total assets of the banking system, others were found to have the strength to withstand such a risk.

In September 2007, following the financial crisis in the US, RBI started a monthly reporting system to capture the banks’ overseas exposure to off-balance sheet items (primarily credit derivatives and investments such as asset-backed commercial papers and mortgage-backed securities). An analysis of such information so far has revealed that the banks’ exposure to such instruments has gradually come down from June 2008. The MTM losses, however, gradually increased up to March 2009, reflecting the impact of the sustained fall in value of the assets. |

Government approves 13 FDI proposals worth US$ 81.9 million

New Delhi

|

|

The government has approved 13 foreign direct investment (FDI) proposals worth US$ 81.9 million based on the recommendations of the Foreign Investment Promotion Board (FIPB). The government has cleared the proposal of Essel Group-promoted Dish TV India, aimed at bringing in foreign inflows of US$ 50.7 million.

Further, Sterlite Technologies' plan to issue and allot warrants valued at US$ 21.64 million on preferential basis has also been granted. TM International's US$ 8.33 million proposal to issue shares against consideration other than cash and Kludirak India's plan to set up a joint venture to enter the cash-and-carry trading segment were also approved. Other approved proposals are those of Sistema Shyam TeleServices, General Motors Acceptance Corp, S&S Media (India) Enterprises of Bangalore, Taneja Aerospace, Ramboll Singapore Pte, Kludirak India, InfxQ Knowledge Services, L Occitane Singapore, Strata Geosystems and Devas Multimedia. |

Europe looking at Indian markets for

further growth

New Delhi

|

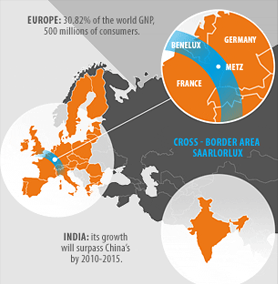

If it was “focus China” in 2006, it is time now for the European companies to shift their focus towards India to not only overcome the current crisis but to exploit it for their future growth, said Moselle Development Council vice-president Claude Bitte, which is part of France and connecting Germany, Northern Italy, France, Belgium. There is no growth in the European markets and the companies in the region are seriously looking out Asian markets for future growth. Given the huge opportunities particularly in the infrastructure and transportation sectors in India, European companies have shifted their focus towards India and seek to play a major role in the Indian market, he said.

|

Towards this move, France will be conducting a three-day exclusive business (B2B) event on Euro India Transport Systems (EITS), the first ever and largest one to be held at Moselle (eastern France). Over 1,200 companies from European countries and 300 companies from India are expected to attend the event to explore business opportunities in the areas such as automotive, aeronautics and aerospace, rail, truck/bus, ship building, transport and logistics industries. Companies such as Airbus, Bombardier, Alsthom, Corus Rail (Tata Group Co), ArcelorMittal among global majors and a host of SMEs are looking at Indian partners to explore markets in a big way. These companies seek to either set up manufacturing plants on their own or joint ventures apart from looking at outsourcing components, products and parts and giving sub-contracting jobs to Indian companies, said Bitte.

EITS is the largest event dedicated to the transportation industry, being organised by Moselle General Council in associations with respective governments. The event is purely business oriented and will have pre-arranged, one-to-one business meetings with Indian and European companies. Till date, over 600 European and 200 Indian companies have already signed up for the event which will provide a conducive business atmosphere among the participating companies, said Philippe Leclerc of Proximum, the event management company.

Companies such as tyre major Michelin and Cryolor Air Liquid have proposals to set up plants in Chennai with huge investments. There are number of companies including Airbus, Bombardier and Alsthom have proposals to either directly enter the country or roping in local partners to jointly manufacture components for aircraft, rail etc, he said. “Not only they want to do business in India for the market but also exporting to neighbouring countries making India as hub,” he said. Transportation holds major share out of the euro 70 billion bilateral trade between India and European countries, which is expected to touch euro 160 billion by 2015, he said further. This event will provide a fillip to the growing demand for transportation network in India, he added. |

|

FDI rises 56% in July

Foreign direct investment inflow to India was $3.5 billion in July, 56 per cent higher than $2.25 billion in the same month a year ago, the Commerce and Industry Minister, Mr Anand Sharma, said. The Minister said inflows of $3.5 billion received during July 2009 are as against $2.5 billion received during June 2009 and $2 billion received during May 2009.

The figure represents an increase of 36 per cent over June 2009, which, in turn, was an increase of 23 per cent over the equity inflows received in May 2009. He added that despite the current economic situation, FDI equity inflows amounting to $10.532 billion were received during April-July 2009, which is as against $12.3 received in April-July 2008.

“The corresponding amount in April 2007 to July 2007 was $5.7 billion, compared to which FDI equity inflows during the current financial year have increased by nearly 85 per cent,” he added. The sectors that attracted strong FDI inflows included services at $1.86 billion, housing and real estate at $1.18 billion and construction activities $0.68 billion among others. During April-June, Mauritius, the US, Cyprus, Japan and Singapore were the major investor countries, with the island nation investing $3.37 billion in India.

Source: The Hindu Business Line |

Industry grows by 4.6% in April-July

The cumulative industrial growth during the first four month period (April to July) of the current financial year stood at 4.6%. The figures for the corresponding period of previous year was 5.6%.Manufacturing sector showed a growth of 4.3% during this period (as against 6% during same period of previous year) while mining showed a growth of 2.5% (3.7% last year) and electricity grew at 5.6% (2.6% last year). Though the overall figures appear encouraging, there is still some concern over the fact that capital goods production, which is an indicator of induction of fresh manufacturing capacity, grew by only 2% in April to July 2009, as against the 10.4% growth shown by this sector during corresponding period of previous year. |

Sensex crosses 17000 mark

Bombay Stock Exchange Index (Sensex) crossed the 17000 mark on 30 September, a level that was last touched 16 months ago, in May 2008. The present rally, which saw the index gaining 1000 points in a span of mere 16 days, has been sustained by strong inflows from Foreign Institutional Investors (FII’s). It is estimated that FII’s have invested over Rs. 130 billion in the Indian stock markets in September alone, while retail investors and domestic institutions were net sellers during this period. The continued availability of the funds globally at low rates and the weakening of US $ on worries that it would lose its place as worlds reserve currency are considered to be the factors that have contributed to the refund flow in the equity markets in the emerging economies. |

India attracts US$ 3.47 billion FDI in July 2009

India attracted US$ 3.47 billion foreign direct investment (FDI) in July 2009, compared to US$ 2.24 billion in July 2008, according to official data. The country's total FDI inflow during April-July 2009 stood at US$ 10.49 billion. The services sector invited a significant 20 per cent of the total FDI inflow during April-July 2009. The country received US$ 2.14 billion FDI in services during the period, the highest among all sectors. The housing and real-estate attracted US$ 1.41 billion in investments while the telecommunications sector attracted investments worth US$ 993 million. According to official data, the highest FDI contribution of US$ 4.55 billion came from Mauritius, followed by the US and Singapore during the period. To facilitate foreign investment, the government has recently approved formation of an investment promotion firm ‘Invest India’ that will partner with the states and the industry to provide foreign investors a hassle-free entry.

Source: IBEF |

|